Understanding the Implications of Credit Card Cloned in Business

The world of business is constantly evolving, and with it, so are the methods used by fraudulent entities to exploit vulnerable systems. One of the most pervasive threats facing businesses today is credit card cloning, which has significant implications for financial security, customer trust, and overall operational health. This article will delve deep into the meanings and impacts of credit card cloned scenarios, how they relate to issues of fake banknotes, fake money, and counterfeit money, and provide actionable strategies for businesses to protect themselves.

What is Credit Card Cloning?

Credit card cloning refers to the unauthorized copying of information from a credit card's magnetic strip or chip, allowing fraudsters to create a duplicate card. This clone can be used to make purchases without the cardholder's knowledge, leading to potential financial loss and damages to a business’s credibility.

The Mechanism Behind Credit Card Cloning

Understanding the mechanisms of this crime is crucial for any business owner. Here are some common methods that fraudsters use to clone credit cards:

- Skimming Devices: These small, discreet devices are often attached to ATMs, gas station pumps, and point-of-sale systems. They capture card data when a customer swipes their card.

- Data Breaches: Cybercriminals may hack into a retailer's network to obtain credit card information stored in databases.

- Phishing: Fraudsters may use deceptive emails or messages to trick individuals into providing their credit card details.

Impact of Credit Card Cloning on Businesses

The adverse effects of credit card cloned incidents extend widely within the business environment, including:

1. Financial Losses

When fraudulent transactions are executed via cloned cards, businesses bear the burden of chargebacks. These are corrections made to payments that often result in financial losses, compounded by penalty fees imposed by payment processors.

2. Damage to Reputation

Companies that suffer from a credit card cloned situation risk damaging their reputations. Customers who hear of fraud related to a business may opt for competitors, fearing for their financial security.

3. Legal Repercussions

Businesses may face legal actions from affected customers if adequate security protocols are not in place, highlighting the need for stringent protective measures against such thefts.

4. Increased Security Costs

To safeguard against future incidents, businesses may need to invest heavily in cybersecurity measures and training, diverting funds that could be used for growth.

Preventive Measures Against Credit Card Cloning

Combatting the risk of credit card cloning requires a proactive strategy that encompasses multiple layers of security:

1. Enhance Point-of-Sale Security

Ensure that all payment terminals are equipped with up-to-date encryption technology. Consider implementing chip-and-PIN systems that provide a stronger form of authentication.

2. Regular Security Audits

Conduct routine inspections and audits of your financial systems and payment processing methods to identify vulnerabilities.

3. Employee Training

Invest in training programs for employees on recognizing potential fraud attempts, such as skimming devices or phishing scams.

4. Customer Awareness Programs

Educate your customers on how to protect themselves against credit card fraud. Encourage them to monitor their statements regularly and report suspicious activity.

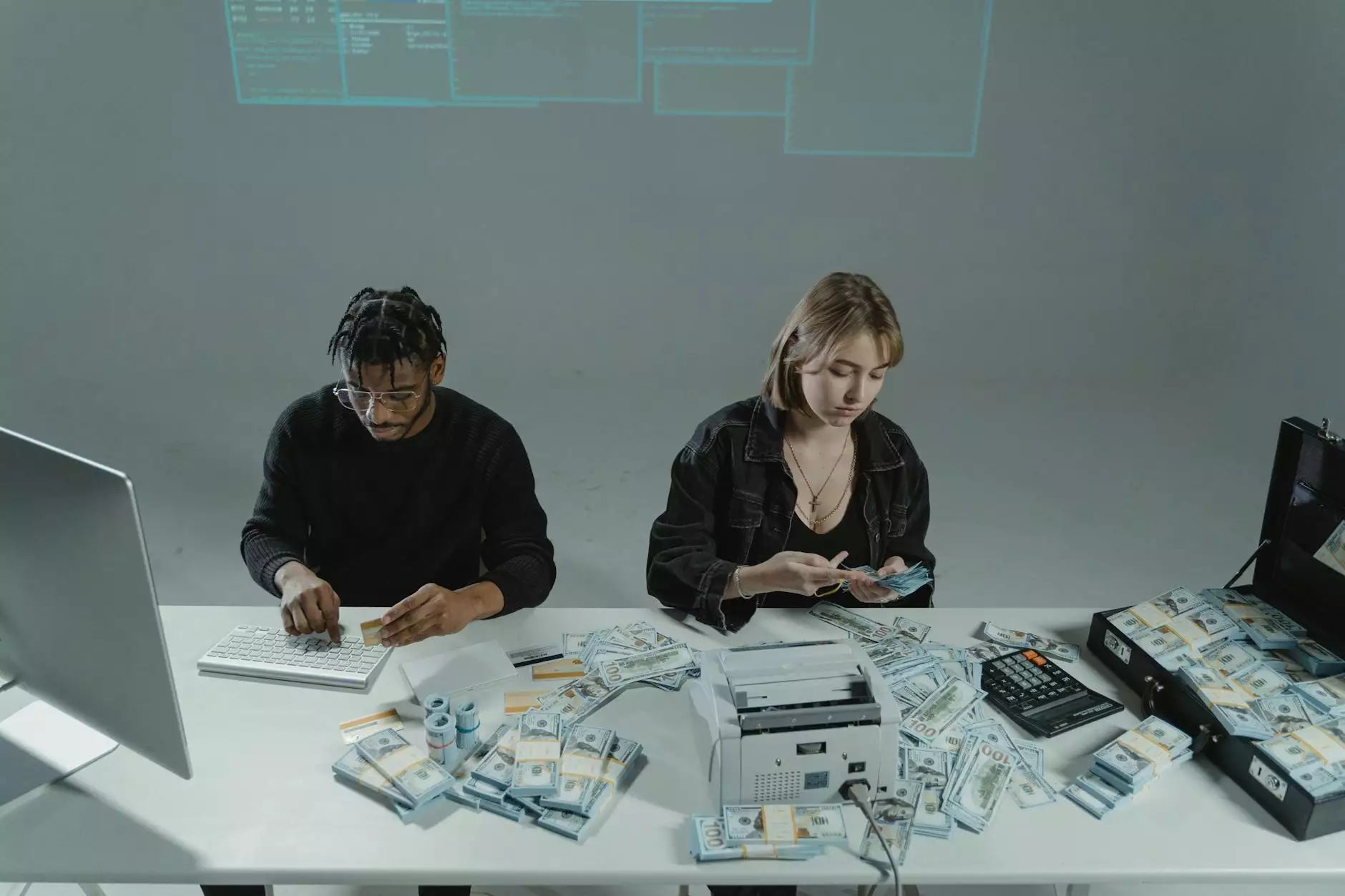

Understanding the Linkage with Counterfeit Currency

While credit card cloned incidents are alarming, businesses should also be aware of counterfeit currency, which includes fake banknotes, fake money, and other forms of financial fraud.

Similarities Between Credit Card Cloning and Counterfeit Currency

Both crimes threaten the integrity of financial transactions and impact businesses significantly. They share common traits, including:

- The illicit production and distribution of financial assets.

- The impact on customer trust and business reputation.

- The potential for legal consequences and financial penalties.

Preventing Counterfeit Currency Usage

To prevent counterfeit bills from entering your business's cash flow, consider the following strategies:

- Education: Train employees on how to recognize genuine currency through security features.

- Verification Tools: Invest in counterfeit detection tools such as UV lights and counterfeit money markers.

- Secure Transactions: Encourage electronic payments to minimize the exchange of cash.

The Future of Secure Transactions

As technology advances, so do the methods of both fraud and security. The development of new technologies, such as biometric verification and blockchain transactions, is paving the way for more secure business practices that can reduce incidents of credit card cloned cases and counterfeit currency.

Adopting New Technologies

It’s essential for businesses to remain ahead of the curve by adopting emerging technologies that enhance transaction security:

- Biometric Authentication: Technologies that use fingerprints, facial recognition, or retina scanning add an additional layer of security.

- Blockchain Technology: Leveraging distributed ledger technology can provide transparency and reduce fraud risks within transactions.

- Artificial Intelligence: AI can help detect anomalies in transaction behaviors, flagging suspicious activities before they cause harm.

Conclusion

The implications of credit card cloned incidents extend far beyond immediate financial loss; they can reshape the very landscape of trust and reliability in business. By implementing robust security measures, educating both staff and customers, and staying abreast of technological advancements, businesses can protect themselves against the pervasive threat of fraud, including fake banknotes, fake money, and counterfeit money. In an increasingly interconnected world, vigilance and education are our best defenses against the dark side of finance.